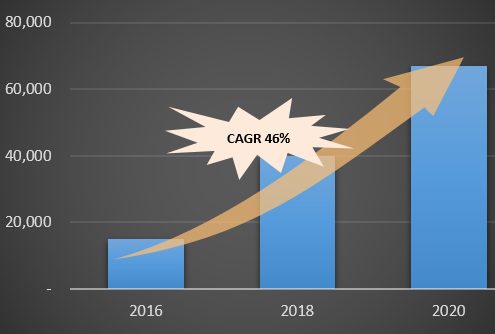

Source : UDC

Hyunjoo Kang / jjoo@olednet.com

UDC (Universal Display Corporation), enabling energy-efficient displays and lighting with its UniversalPHOLED® technology and materials, today reported financial results for the first quarter ended March 31, 2016.

For the first quarter of 2016, UDC reported net income of $1.9 million, or $0.04 per diluted share, on revenues of $29.7 million, compared to net income of $1.3 million, or $0.03 per diluted share, on revenues of $31.2 million for the first quarter of 2015.

“In the first quarter, our commercial emitter revenues grew 8% year-over-year, primarily driven by strong green emitter shipments. Royalty and license fees increased by 22%. Host material sales, in line with expectations, declined year-overyear,” said Sidney D. Rosenblatt, Executive Vice President and Chief Financial Officer of UDC

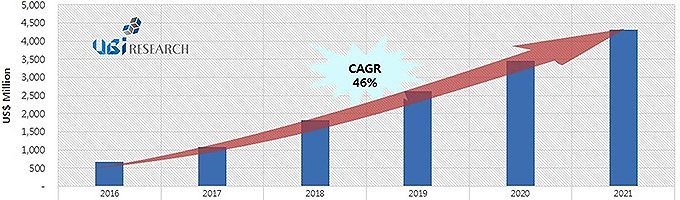

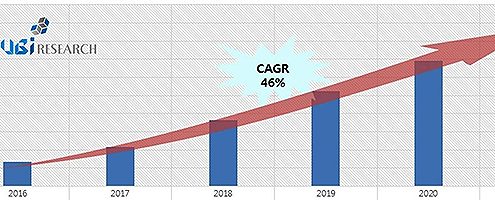

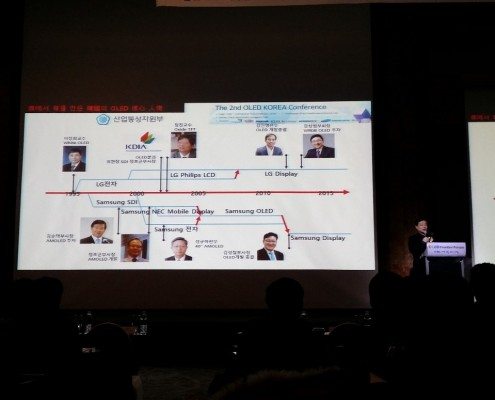

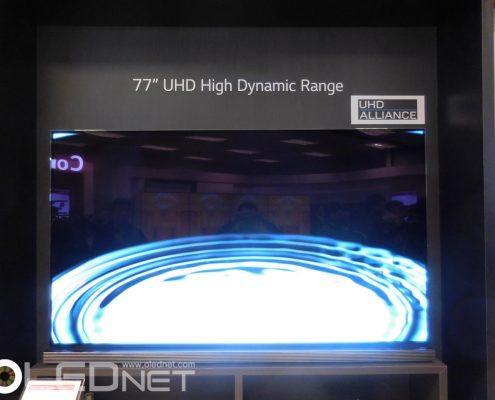

Rosenblatt continued, “The OLED landscape continues to expand. New OLED products are launching, capacity is building, equipment bookings are increasing and the pipeline of OLED design activities is broadening.

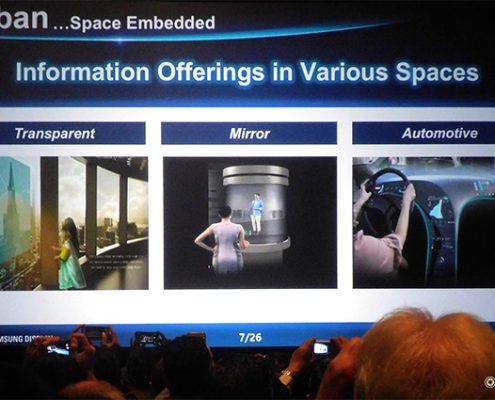

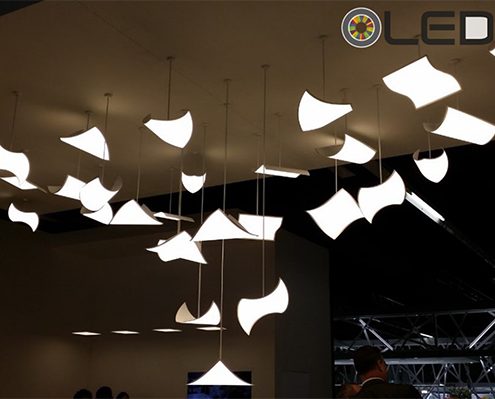

With OLED display penetration at only about 10% of the total consumer electronic display market, new applications like automotive, virtual reality, augmented reality and signage emerging and OLED lighting transitioning from development stage to commercial, we believe that our long-term growth trajectory remains strong.”

Financial Highlights for the First Quarter of 2016 The Company reported revenues of $29.7 million, compared to revenues of $31.2 million in the same quarter of 2015.

Material sales were $24.3 million, down 9% compared to the first quarter of 2015, primarily due to a $5.0 million decrease in host material sales. This decline was partially offset by an increase of $2.5 million in emitter material sales.

Royalty and license fees were $5.3 million, up from $4.4 million in the first quarter of 2015.

No revenue was recognized under the Samsung Display Co., Ltd. (SDC) licensing agreement in the first quarter, as SDC is obligated to make licensing payments in the second and fourth quarters of the year. For 2016, the Company expects to recognize $75 million in SDC licensing revenues for the full year.

The Company reported operating income of $2.5 million, up from $1.8 million for the first quarter of 2015. Operating expenses were $27.2 million, compared to $29.5 million in the same quarter of 2015.

Cost of materials was $5.1 million, compared to $8.6 million in the first quarter of 2015, reflecting the decline in host material sales volume, which have less favorable margins than the Company’s emitter materials.

The Company’s balance sheet remained strong, with cash and cash equivalents and investments of $395.7 million as of March 31, 2016.